It’s always good to take a lesson from history but it is also good to keep in mind that arm-chair quarterbacking a play doesn’t address the real world problems of the next play. Since none of us can see into the future, our best analytical tools can only look at charts and graphs and project or predict that the chart will continue in the same direction or that the graph line doesn’t start plummeting downward. There are a number of technical and sophisticated mathematical algorithms that are used by stock trading firms that help investors of all sizes to maximize their returns. Up and down dramatic swings always tell us something about what could happen or what might happen next. The upward or downward motion of indicators also can tell something about a market such as valuation, either over or under. For example, right after 9/11 the internet bubble burst which was quickly followed up with the Biotech/Pharma/Lifesciences burst bubble. Valuations of public and private companies in both sectors plummeted.

I remember being at a Venture Fund conference in 2004 in New York City and the key note speaker said to the general audience that ‘… it didn’t matter the depth of investment, intellectual property or management team, the valuation of any startup is $5MM…’ peddle forward to the last Angel Investment conference I went to in Boston in 2013 and the key note speaker said ‘…it doesn’t matter what you think your company and technology is worth, we (Angels) take a minimum of 40% of your equity for $2 million’. I had the urge to punch the guy, just to teach him a lesson after he proudly followed it with ‘….one of our Angels came in to help add equity to the balance sheet and got a 9x return on $4 million in less than 6 weeks’. After I asked him what the founder’s got and how much they owned of the acquisition it turned out to be less than 11% split between two guys, which were fired after the acquisition and had to go out and get jobs! That scenario was last spring, nearly one year ago. While I don’t begrudge investors making money the argument of the rising waters floats all boats is quite frankly a pile of steaming manure. Valuations are still at the bottom and while they are rising, it’s not enough to offset the high failure rates of drug development in our industry.

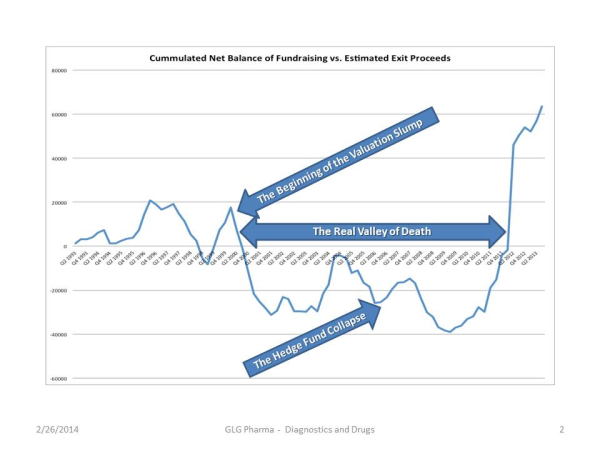

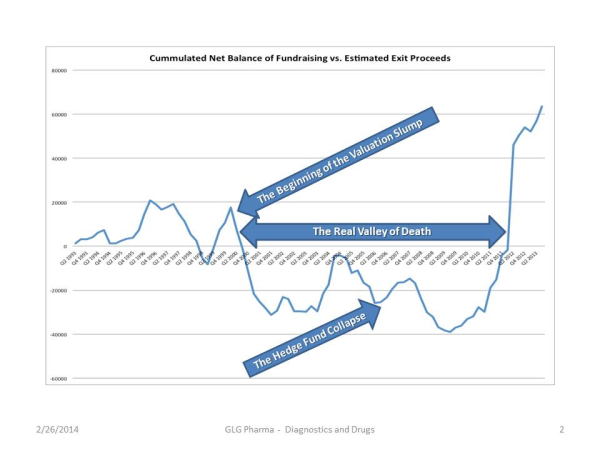

So looking at the chart there was an uptick just prior to the crash in 2000 and there was also an uptick when the hedge funds crisis and the largest recession since the great depression (1929) in 2007 started. But starting in the first quarter of 2013 the zero line was crossed, meaning that VC’s were now going to make a lot of money. So now the upward climb of the tracking information looks like the North Slope of the last part of the climb at Mount Everest, so it is logical to assume that there is a top and that there will be a correction. How far, how deep and when it will occur? Who knows? I don’t.

What else does this dramatic step up in valuation increase tell us? The message to entrepreneurs might be to fight a little harder for your equity valuations but then again, most of the entrepreneurs that I know are still in the mind set of ‘give me money at any valuation’. So are the assets of a startup, which include people, are those assets undervalued and are the returns on investment over the top for the investors? Will valuations catch up with the market forces? The private capital market indexes seem to be doing so since 2013 and rather quickly. Will this translate to the Lifesciences industry? Slowly but deliberately. Eventually, the APP Bubble will deflate and all the shares that were priced into the stratosphere will find the other side of Mount Everest, the downside but then again, look at Google, look at Facebook. Looking at SharePost’s tracking of “after financed VC companies” that qualified investors can now invest in and do it through the recent announcement by the NASDAQ and the broker-dealer SharePost. One example is DropBox which now has a pre-IPO market capitalization of $9 billion. How many Lifescience companies that list on the US exchanges today have public market valuations over $9 billion? Not many. And that is the crux of the problem of our industry and the start-up’s that feed that industry and take ‘unnecessary risks’.

There are VC firms that have made a lot of money during the interim period, some of them went to China, India and Latin America, exporting US, UK and EU technologies, services, manufacturing and re-introducing those products and services back into their own economies and markets. Some of them were successful in selling their investments to pharma and biotech giants. And some of them and the companies that they funded, disappeared. Technology, jobs and opportunities lost. Neither Aspirin nor any approved antibiotics are made in the US any longer and haven’t been for quite some time. All of it outsourced.

The true picture of what happened during the ‘real valley of death’ in the life blood of the industry, capital can be seen below:

Link to glgpharma

Since January, 2014 there were 36 IPO’s from venture backed companies, 24 of them were biotech companies. The 36 companies raised $3.3 billion or about $83MM average with the highest being a medical software product company that will list on the NYSE Euronext with a high end raise of $200+MM. We have not seen this kind of IPO activity since the year 2000 in our industry and of course, everyone is now crying ‘Biotech Bubble’. Is it true? Is this another Biotech Bubble soon to burst? Only time will tell but if enough analysts and VC’s continue to vocalize the concept, a crash will surely happen. When, well that’s anyone’s guess. What will keep the crash from happening are the consistent and constant revenue increases and approvals of drugs for diseases.

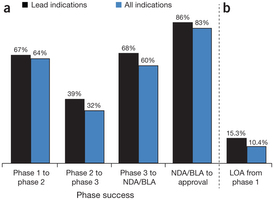

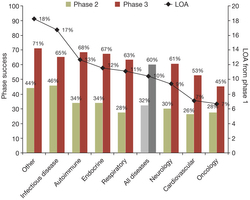

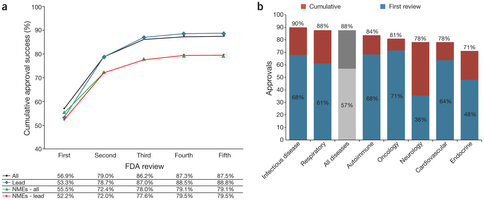

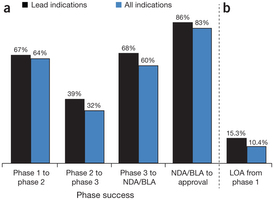

So with all the improvements in drug development strategies have the odds yet improved? A recent study by Michael Hay et al stated:

“The study is the largest and most recent of its kind, examining success rates of 835 drug developers, including biotech companies as well as specialty and large pharmaceutical firms from 2003 to 2011. Success rates for over 7,300 independent drug development paths are analyzed by clinical phase, molecule type, disease area and lead versus non-lead indication status . . . Unlike many previous studies that reported clinical development success rates for large pharmaceutical companies, this study provides a benchmark for the broader drug development industry by including small public and private biotech companies and specialty pharmaceutical firms. The aim is to incorporate data from a wider range of clinical development organizations, as well as drug modalities and targets. . .

To illustrate the importance of using all indications to determine success rates, consider this scenario. An antibody is developed in four cancer indications, and all four indications transition successfully from phase 1 to phase 3, but three fail in phase 3 and only one succeeds in gaining FDA approval. Many prior studies reported this as 100% success, whereas our study differentiates the results as 25% success for all indications, and 100% success for the lead indication. Considering the cost and time spent on the three failed phase 3 indications, we believe including all 'development paths' more accurately reflects success and R&D productivity in drug development.” (Nature Biotechnology Hay, M. et al Nature Biotechnology 32, 40–51(2014) doi:10.1038/nbt.2786 Published online 09 January 2014)

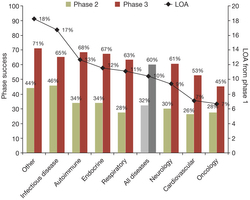

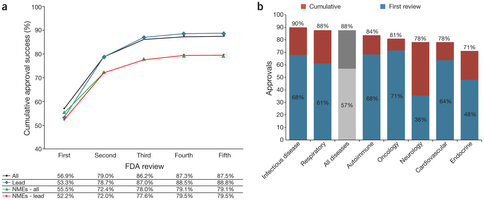

Pictorially, our industry looks like this:

What does this say about the sudden boom in IPO’s? Since 2011, the improvement in drug approval success would not be great enough to justify the sudden resurgence of a market that has perhaps moved the approval pipeline stats up about 1-2% from the 1980-2000’s which was reported to hover at the 9-10% range (2011 we are in the 10-15% range the way I read the data). There is a danger though in over analyzing cumulative data across multiple diseases, it tends to blur the real progress that is often being made in a particular area of disease treatment. Blurring the disease categories with other areas that have always been notoriously difficult such as anything in the neural area, i.e. Parkinson’s, Alzheimer’s, Bipolar and Schizophrenia and let’s not forget Migraines, brings the overall industry down! Part of the higher failure rate is due to the lack of capital in the industry overall. VC’s abandoned the biotech/pharma/Lifescience space by the droves. So not only was it a death valley for return of investment capital after the last Biotech Bubble in 2000 burst, the rate of drug approval has gotten harder and the FDA and EMA are demanding more data, more information, more clinical trials and all this translates to higher risk, higher cost for any company when capital is short to non-existent.

Pharma companies and large Biotech’s that have lots of cash and the right talent and risk taking, reduce their risk by spreading across multiple drugs in development with multiple markers or targets that can be validated and might be unique. But the industry in the large Pharma and Biotech area has often proven itself to follow the Lemming mentality and our intrepid Authors state:

“Factors contributing to lower success rates found in this study include the large number of small biotech companies represented in the data, more recent time frame (2003–2011) and higher regulatory hurdles for new drugs. Small biotech companies tend to develop riskier, less validated drug classes and targets, and are more likely to have less experienced development teams and fewer resources than large pharmaceutical corporations. The past nine-year period has been a time of increased clinical trial cost and complexity for all drug development sponsors, and this likely contributes to the lower success rates than previous periods. In addition, an increasing number of diseases have higher scientific and regulatory hurdles as the standard of care has improved over the past decade.”

So in our industry we have heard much about the ‘Valley of Death’ coupled with living in the land of ‘Nosferatu’. It is so bad in our industry that the Government has recognized the problem and is attempting to provide funding and funding encouragement once a product or technology has a ‘proof of concept’. The Valley of Death is described as that space in between validation of a discovery (a pre-clinical state) where a compound is selected for advancement into clinical development and Phase 2 human clinical trials. The concept is that once a product reaches Phase 2 clinical trials, the investment community, the VC’s would then join in and fund the advancement of the products. The Valley of Death has always been there in drug development, large and small companies’ management must decide on which compound to advance into clinical development. A risky decision that can have dire consequences if the product fails in Phase 3 or the FDA and/or EMA agencies decide the drug is not efficacious or too toxic for the patient population.

At GLG we bring years of experience in selecting drugs and helping them get through the clinical development and approval process. We have over 15 approved drugs and nearly 30 diagnostics and several over the counter products that we all individually or as a team, have helped discover, develop and get approved. Sometimes the best drug is not always the one that has the lowest binding affinity, why? Well the drug might be great binding in vitro and in vivo models that are based around cell and animal model technology but have awful human clinical trial results. A good bio distribution, low toxicity, good efficacy is what everyone is searching for in our industry (along with a host of other very important characteristics etc.). So when you have a drug that has been tested across multiple animal models in different diseases and continues to knock out the disease target that is based on a biological marker, it probably will make it through clinical development and into the market. However, there are no guarantees and the risks are high but the sales often sky rocket like a new consumer device or product. Driving valuations of Biotech companies into the stratosphere, maybe even as high as Drop Box’s $9 Billion?

Also, want to learn more about new financing models? Contact Poliwogg by clicking the picture link below!

Comments