(What's In It For Me?)

Many years ago Maureen Doerr at Doerr Associates[1], (pronounced Door) explained to me how to sell an idea to an unknown prospect. Notice that I said prospect and not customer because Maureen reasoned, rightly so, that a prospect becomes a customer when they buy something from your company. A prospect sometimes doesn’t know they want to buy something from you until you Advertise or Promote the ‘something’. Stick with me on this. WIIFM is simply “What’s in it for me”? It has stuck with me ever since.

Maureen Doerr, President Doerr Associates

This is a simple concept that should, theoretically, drive just about everything your organization does to make your products and services and your company a success, including research! All facets of the business you are planning to build should be geared to answering the WIIFM of your prospects and also your continuing customers. And making sure that what is driving your research and development and ultimately your manufacturing, marketing and selling engine, is focused on answering the WIIFM for new prospects, new customers and loyal customers. The answers to each group may not necessarily be the same. Sometimes the products aren’t the same either, think Sonites and Vodites[2], for those of you that know what those two products are, you know what I’m talking about…for the rest of you, try googling the terms, its fascinating stuff!

In health care, especially in disease oriented healthcare, our prospects are the patients, advocacy groups, healthcare insurers, government agencies, physicians, clinicians, families, institutions and the research and development community at large. Add to that the investment community which includes venture capital, angel capital, friends and family, private equity, institutional capital, research funds and grants, government funds plus the stock market; it’s a pretty complex scenario. It is so complex, that everyone tries to simplify it just in order to try and understand or attempt to understand just what the heck is going on in the market. I know I have that problem; this is way too complex for my puny brain.

Oversimplification can at times add to the confusion and miss the WIIFM of our target prospect audience, new customers and existing customers. Sometimes these groups don’t want the same thing. Take me for instance, I love my Blackberry (still do) and everyone laughs at me. But I grew up with a Blackberry when it would only do email and within a company network, you could do something that today is called ‘texting’ from one person to the next, securely.

If Blackberry had been paying attention to Apple, Microsoft, Google and others including Samsung, and the younger generation, they might still have the lion’s share of the market or at least a cougar’s share. But they didn’t pay attention to WIIFM's. So how did that happen? I don’t know and I’m not smart enough to guess. Only the ex-management team and employees of Blackberry (RIM) could tell us. Same thing happened to Xerox, IBM, Bell and Howell, Polaroid, Atari and countless others. The same process will happen to the many now ‘darlings’ in healthcare. It seems impossible for any of us to see past the ends’ of our noses and it seems almost impossible for any of us to predict what the next new technology breakthrough will be or where it will occur across the globe. Blackberry always satisfied my WIIFM’s because I am a loyal customer, stupid, stubborn but loyal.

I’ve always tried to put myself in the shoes of the prospect that I want to talk to. Sometimes this works, but not always. The prospects I want to talk to are the 8.5 million qualified accredited investors[3] in the United States BEFORE the Securities and Exchange Commission shrinks that number down to about 2-3 million through added restrictions. Everyone wants to talk to them and so far, as a group, they are pretty clammed up. I don’t think we yet understand their WIIFM’s. Or at least I don’t.

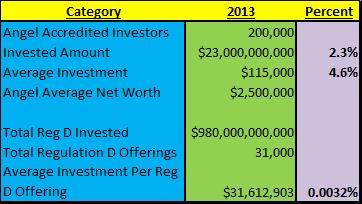

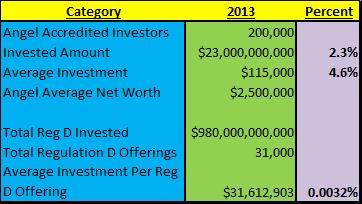

A really good summary of the Accredited Investor market was put out by the Angel Capital Association and addressed to the Honorable Mary Jo White Chairperson of the Securities and Exchange Commission[4] calling for White to NOT restrict Accredited Investor Requirements further as only about 200,000 of the 8.5 million Accredited Investors actually participate in Regulation D investments. Just to provide some perspectives, according to the article, there were 31,000 Reg D offerings issued in 2013 compared to 954 public offerings. In that same year, $980 billion was invested under Reg D (granted they were not all accredited investors because it includes businesses and institutional investors etc.) compared to $250 billion in the IPO market raised during the same time period.

The Honorable Mary Jo White, Chairperson of the SEC

So let’s do some elementary simple math of averages:

Only 2.3% of the total Reg D market is composed of Accredited Angel Investors capital ($23billion) and they on average risk $115K of their average $2.5MM net worth or less than 4.6% of this AVAILABLE resource for investment! Looking at this issue from the far-out and somewhat unreliable perspective of averages, the total 8.5 million accredited investors who have an average net worth of, wait for it, at a Net Worth of $1.0mm represent about $8.5 trillion or some percentage of that number, to possibly invest or put at risk. And of that 8.5 million Accredited investors, the the current $23billion represents 0.27% of their average net worth! In other words, what makes the SEC think that suddenly 99.7% of the NON PARTICIPATING accredited investors are suddenly going to throw all of their assets to the wind and invest in Regulation D companies?

So why is the SEC so focused on Restricting Accredited Investors? They hardly made a dent in the Regulation D market! Don’t get me wrong, if you or me as an entrepreneur, got funding from one of the 200,000 investors in 2013 we would be delighted!

Reality is that nearly all of the Regulation D market is composed of SOPHISTICATED Institutional investors who are by the way, capturing all the upside of new companies that are now listing on the exchanges!

Obviously, we as an investment seeking community of struggling lifescience entrepreneurs are seeking investments for our research and development endeavors to cure, treat or eradicate disease, don’t know the WIIFM of the other 8.3 million Accredited Investors, many of whom remain silent, unapproachable and generally disinterested in healthcare, until it’s too late, either for them as individuals or for a family or friend suffering from the sudden onset of a disease or chronic ailment. Then, sometimes, they may become motivated.

So do the math. For 31,000 offerings that are on the Reg D filing there are probably another 10x that never make it to that stage, 300,000 plus good ideas that go virtually nowhere or flounder: in regione vivorum mortuis[5]. The Secretary of Energy, Steven Chu supposedly coined this term, ‘the valley of death’, apparently in 2009; but I swear I have heard it before[6]. This Valley of Death is the no-finance-available zone between idea and application and the finding of customers that are willing to pay for the discovery, whether it’s a product or a service.

First and foremost, Reg D filings are NOT CROWD FUNDING investment opportunities. REGULATION D is presently reserved for the very rich as well as institutions, funds and capitalists who have gathered the wherewithal to fund new startups or advance a startup from a slow startup growth to accelerated high growth by providing capital for expanding manufacturing, marketing and sales to meet the new demand. So far, 8.3 million rich, accredited investors are not interested in participating in one of the largest investment opportunities in the history of the United States. Why is that? Well we haven’t figured out their WIIFM’s, now have we?

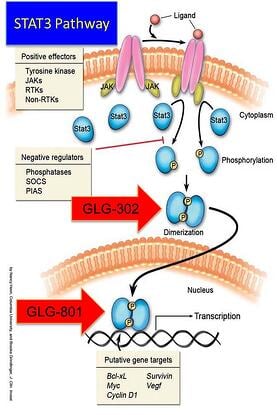

Interesed in GLG Pharma and our fight against cancer and proliferative diseases? Visit us:

GLG PharmaWant to find out more about Accredited Investor Funding to fight cancer? Visit:

Polliwogg

[2] http://web.stratxsimulations.com/simulation/strategic-marketing-simulation/

[3] http://www.federalreserve.gov/releases/z1/current/accessible/f7.htm

[4] http://www.angelcapitalassociation.org/data/File/pdf/ACA_Accredited_Investor_Def_Comment_Letter_02-28-14_%282%29.pdf

[5] in regione vivorum mortuis: “In the Land of the Living Dead”

[6] http://www.bizjournals.com/boston/stories/2009/08/17/editorial4.html