Where is all the money?

If you are a company starting a 160 character limited social media communications product or an app to take money away from Verizon, AT&T and Sprint as well as all the piratical foreign phone services that cream you for many more dollars than the service are actually worth. For these social media and software app companies, investments is not a problem; or let’s say, that raising the money is less of a problem when compared to Lifescience startups current financial woes. If you’re a biotech/pharma/Lifesciences company startup, the odds of finding investment capital are better by playing the lottery in your home state. Steve Burrill a longtime supporter and follower of the Lifesciences industry commented at the Moffitt Cancer Center annual meeting for startups and technology, as the key note speaker that “…only 1 out of 150 startups receive funding from Venture Capital.” Another veteran of VC funding of sorts was involved with J&J’s Venture fund and commented that over 99.9% of the plans submitted to J&J venture funds were rejected out of hand. So far, the odds according to many observers; stack up against the formation and funding of a drug development company but there is hope and maybe a new route is here:

- SBIR/STTR (this isn’t new) – While the NIH shows across different agencies an awarding of grants in the 15%+ average, it only reflects the number of applications that are reviewed versus awarded and not the number of applications submitted to the various agencies. Many applications aren’t even reviewed and rejected out of hand. No explanation for rejection is available, just rejection. Here’s a paper that reviews some of this for you. If you want to get an understanding of how the system works, Tony Fauci’s NIAID (National Institutes of Allergy and Infectious Diseases) gives a little tutorial. I’m still confused.

- Government sponsored research on selected technologies and products. This is an up and coming area for the NIH and programs at various agencies select products across all diseases for funding. The catch is that none of the funding comes to the company directly but is rather paid out to third party providers to advance the technology or a product to the proof of concept stage or actual FDA application. Other resources may then become available such as matching grant funds and other incentives to get investors to the table. A good example is NCI’s Prevent Cancer Program. GLG’s product GLG-302 has been selected for this program. Check out your institution at the NIH where your technology can have a benefit to a patient population and see if they have such a program. If the NCI funds GLG-302 to its end point, which is an IND (Investigational New Drug Application) application to the FDA for long term cancer prevention therapy with our product, it’s worth $3.5-$4.5MM to the company, that the NCI will pay directly to 3rd party providers to accumulate the necessary data for the IND application. For GLG Pharma this is a miracle and we are so grateful to the NCI and the independent reviewer researchers that approved our submission. For women with breast cancer, this product could save their lives. The NCI wins, the taxpayer wins, the patient wins and we get a drug to market, so our investors will win.

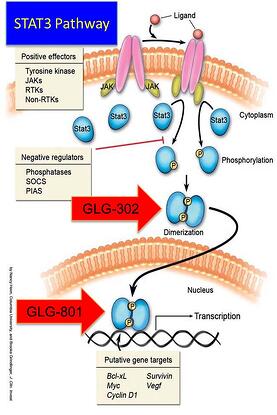

- Local, State and friends of the company money. This also includes your friends and family money. GLG has had lots of help here and personally, I will always be eternally grateful for all their support. So a quick overview and you can look for similar organizations in your area. We got support from the Town of Jupiter, FL for locating our business there and promising to stay there, which we intend to do! FICR (Florida Institute Commercialization of Public Research) and organization committed to helping fledgling companies advance Florida created technology (our technology comes from the Moffitt Cancer Center in Tampa, FL) in the State of Florida. Along with Paragon Foundation actively supporting local Dade County businesses and we very much needed their help! Along with the local bank, Seacoast National Bank, that has stepped in to help support the Town of Jupiter and GLG. Our technology came from the Moffitt Cancer Center and University of Central Florida plus Yale University and the City of Hope Hospital, all working under an NCI Grant that funded the breakthrough technology of STAT3 inhibition diagnostic and drug treatment program. When our first drug begins to treat cancer or a proliferative disease, the patients will be the first to win and that couldn’t have happened if the NIH hadn’t supported the research at the Moffitt, Yale, City of Hope and UCF. These organizations will also be winners as well as collectively they own about 20% of equity and have royalties and milestone payments as the licensed technology advances. Bottom line, it takes many more people to make a drug company successful. Drug development is a team business and a company and its management as well as its investors, need to be determined and be willing to accept problems along the way and find ways to solve those problems. In that respect, drug development is no different than the teams that build the apps, Twitter, Facebook or Google. It just takes longer and it costs more. Lives are at stake in drug development and that’s the difference.

- Crowd Funding. There are three aspects to Crowd Funding that can be used to change the face of funding for Biotech/Pharma/Lifescience companies. The first is the ‘not for profit’ (NFP) aspect of Crowd Funding, so how could this be used to benefit the development of new therapies? Groups of patients or patient interest groups could in effect under the not for profit moniker raise capital through donations to complete clinical trials or pre-clinical trials for targeted therapies and treatments. This vehicle could operate under the same principles as the NIH’s Prevent Cancer Program by first highlighting the goals and objectives of the funding and second by contracting the third parties to complete the work on behalf of the NFP with the information given to the chosen company or technology. Group associations such as the Polycystic Kidney Disease Foundation (PKD) can do this but on a very small scale. The National Breast Cancer Foundation does this but it’s mostly focused on providing funds to breakthrough research at Universities and Medical Centers and not the actual Development in ‘Research and Development’. If such a group were formed on Razoo or Charidy or Indiegogo or Rockethub or one of the other sites outlined by CrowdCrux. The company receiving these funds indirectly, could also agree to give back to the community by providing a portion of the profits to further fuel drug development or provide funds to foundations such as the PKD. The company could also have advocacy groups that are part of the annual review of technologies and accomplishments. For companies focused on cures and diagnostics for diseases, this shouldn’t be a problem. Razoo claims that over 90,000 charities have raised $200 million dollars using their site.

- Crowd Funding for the public. The SEC for Crowd Funding has yet to complete the written guidelines for ordinary investors so that they can invest in startup companies or private offerings in private companies. The draft documents are available at the SEC site: Crowd Funding. “Under the proposed rules:

- A company would be able to raise a maximum aggregate amount of $1 million through crowdfunding offerings in a 12-month period.

- Investors, over the course of a 12-month period, would be permitted to invest up to:

- $2,000 or 5 percent of their annual income or net worth, whichever is greater, if both their annual income and net worth are less than $100,000.

- 10 percent of their annual income or net worth, whichever is greater, if either their annual income or net worth is equal to or more than $100,000. During the 12-month period, these investors would not be able to purchase more than $100,000 of securities through crowdfunding.

Certain companies would not be eligible to use the crowdfunding exemption. Ineligible companies include non-U.S. companies, companies that already are SEC reporting companies, certain investment companies, companies that are disqualified under the proposed disqualification rules, companies that have failed to comply with the annual reporting requirements in the proposed rules, and companies that have no specific business plan or have indicated their business plan is to engage in a merger or acquisition with an unidentified company or companies.

As mandated by Title III of the JOBS Act, securities purchased in a crowdfunding transaction could not be resold for a period of one year. Holders of these securities would not count toward the threshold that requires a company to register with the SEC under Section 12(g) of the Exchange Act; (A quote from the SEC website). Each company would be limited to $1,000,000 per year funding via this vehicle. While not a panacea for drugs, it could get a company started, along with friends and family money as well as grants, a project could be advanced. The second new/old option:

- Regulation D 506 (b) and 506 (c) regulation changes have been put in place and is a modification of Regulation D that has been in effect for some time. This is also known in money circles as the ‘Crowd Funding for the Rich’ as the requirements are investors must meet the criteria for investment. Again, direct messages from the SEC:

“Eliminating the Prohibition Against General Solicitation and General Advertising in Rule 506 and Rule 144A Offerings; A Small Entity Compliance Guide:

Introduction

Enacted in 2012, the Jumpstart Our Business Startups Act, or JOBS Act, is intended, among other things, to reduce barriers to capital formation, particularly for smaller companies. The JOBS Act requires the SEC to adopt rules amending existing exemptions from registration under the Securities Act of 1933 and creating new exemptions that permit issuers of securities to raise capital without SEC registration. On July 10, 2013, the SEC adopted amendments to Rule 506 of Regulation D and Rule 144A under the Securities Act to implement the requirements of Section 201(a) of the JOBS Act. The amendments are effective on September 23, 2013.

Rule 506(b) of Regulation D

Section 4(a)(2) of the Securities Act exempts from registration “transactions by an issuer not involving any public offering.” Rule 506(b) is a rule under Regulation D that provides conditions that an issuer may rely on to meet the requirements of the Section 4(a)(2) exemption. One of these conditions is that an issuer must not use general solicitation to market the securities.

“General solicitation” includes advertisements published in newspapers and magazines, public websites, communications broadcasted over television and radio, and seminars where attendees have been invited by general solicitation or general advertising. In addition, the use of an unrestricted, and therefore publicly available, website constitutes general solicitation. The solicitation must be an “offer” of securities, but solicitations that condition the market for an offering of securities may be considered to be offers.

Rule 506(c) of Regulation D

Section 201(a) of the JOBS Act requires the SEC to eliminate the prohibition on using general solicitation under Rule 506 where all purchasers of the securities are accredited investors and the issuer takes reasonable steps to verify that the purchasers are accredited investors.

To implement Section 201(a), the SEC adopted paragraph (c) of Rule 506. Under Rule 506(c), issuers can offer securities through means of general solicitation, provided that:

- all purchasers in the offering are accredited investors,

- the issuer takes reasonable steps to verify their accredited investor status, and

- certain other conditions in Regulation D are satisfied.

An “accredited investor” includes a natural person who:

- earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year, or

- has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence).

- An “accredited investor” may also be an entity such as a bank, partnership, corporation, nonprofit or trust, when the entity satisfies certain criteria. The full definition of “accredited investor” is available here: Accredited Investor Definition SEC “. Finally the third option is to go public using the Regulation D capital raising vehicle (because most startups won’t get the necessary valuation or interest from merchant banks to warrant their trying to launch an IPO).

- A number of firms are playing in this space of Regulation D funding but Regulation D funding has also been used to launch public companies. While it is not the preferred route. Reg D initiated pre-IPO offerings are sometimes called a ‘Soft listings’ because the capital is raised privately and then the company files for a public listing on the NASDAQ (has to have a certain valuation, net equity and meet SEC requirements). This process is outside the normal ‘merchant banking’ where the banks float the offering and price the shares according to interest from their well-heeled clients which include individuals but also investment funds, hedge funds, pension funds and other sources of investment capital. Generally, ordinary folks are not eligible for standard IPO investments and usually none are eligible for the Reg D investment opportunities. A large amount of capital is raised using the Reg D filing and it is mostly done for hedge funds, VC funds and other investment type funds (SEC says about $1.5 TRILLION). It has been used some by startup companies, as was its intended design, but a vast majority of the capital that is raised is controlled by large, well-financed groups targeting the very companies (startups) that the regulation was first designed to help. Regulation D review article by the SEC can be found at: Reg D Review 2009-2012.

- One of the companies in the Lifesciences area to promote ‘Crowd Funding’ for Lifesciences (Drugs, Devices and Diagnostics) was created by a broker dealer who had spent years on Wall Street, Jeff Feldman who well knows the ins and outs of raising capital. Mr. Feldman is the founder of Poliwogg an online ‘Crowdfunding’ site and he convinced Greg Simon to become its CEO and spokesperson and Sam Wertheimer, PhD to become Poliwogg’s Chief Investment Officer.

-

- Along with a dedicated staff of experts, Poliwogg will offer not only the Crowd Funding for the not so rich and famous but also offer Regulation D offerings to the Rich and Famous. Poliwogg is also in the process of setting up an investment groups where investors can place their capital for a broad based investment fund dedicated to the Lifesciences area and hopes to see the rate of funding through its portal to be over a billion dollars per year in funding. You can see GLG Pharma, LLC listed on their site.

So what does all this mean for startup companies like GLG Pharma that has a combination of revenue generating products already approved for the market (ready to license and launch), re-purposed drugs with new formulations for new indications (shorter time to approval and marketing), a selected developmental compound for the prevention of ADPKD, breast cancer and other proliferative disorders, a pipeline of rational designed molecules and a diagnostic to monitor the patients for disease and treatment? Come visit our website and find out about us at GLG Pharma or sign up with Poliwogg and learn more about GLG Pharma!